The Seven Deadly Sins of Client Advisors

Executives tell me it’s not easy to find an advisor with the right balance of experience, expertise, relationship skills, and client orientation. That’s not surprising. It’s a difficult role to pull off well. There are also lots of bad habits that professionals fall into when it comes to serving clients.

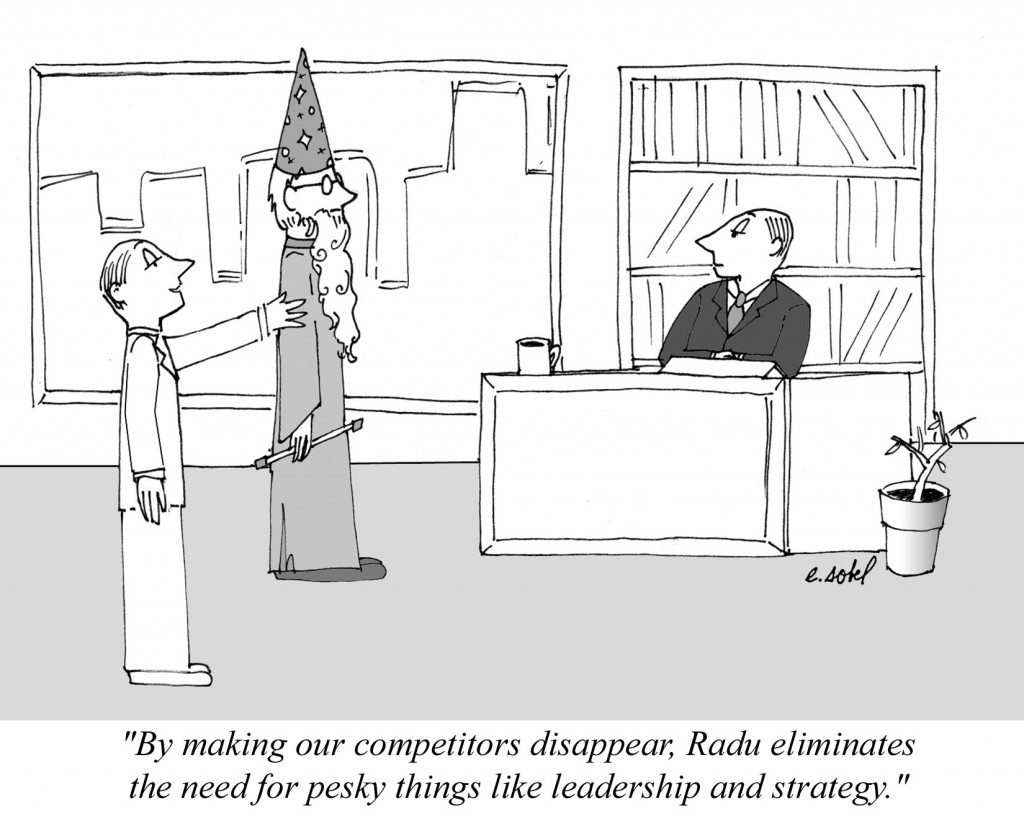

Here are seven types of ineffective advisors that I regularly spot. These are not black-and-white distinctions. Someone could have, for example, characteristics of several of the types.

You may not fully match one of these specific descriptions, but ask yourself: Do you ever commit any of these sins?

1. Agenda-pushers. These are professionals who are focused on what they want and need rather than on the client’s agenda. Basically, they are product salespeople. Many historical advisors diminished their stature and effectiveness by pushing an agenda of personal power and influence. Think former secretary of state Henry Kissinger, advisor to Richard Nixon. Remember, one of the main drives of trust is the client’s perception that you are truly working their agenda, not your agenda.

2. One-size-fits-all. A CEO I knew once told me this: “Many professionals find one good solution and then apply it to every client, to every situation. By way of illustration—I had a friend who got a job as a printer’s helper in college, and then started his own printing business. He’s a very bright, engaging guy. But for him, the solution to everything is a brochure. If you tell him you’ve got problems with your computer, he’ll enthusiastically say to you, ‘Let’s put together a pamphlet.’” One-size-fits-all advisors are hammers looking for nails.

3. Gurus. Gurus are the academics, authors, and consultants who get anointed as visionaries. They are perceived to have a set of hot, leading-edge ideas and they market them from coast to coast in speeches and seminars. Their brilliant framework—not the clients real need or problem—is the center of focus. I once interviewed Reginald Jones, the former head of General Electric and the man who put Jack Welch in the CEO role there in 1981. He commented to me, “I have never really fallen for the gurus. I avoided them entirely. They come in with all the slogans and the buzzwords, they give a spellbinding lecture, and they disappear. Two days later, you can’t remember anything they said that you can really use in the organization. The outstanding professionals, in contrast, offer advice and insights that are more specific and practical. They address your context.”

4. Crowd-pleasers. These are the advisors who tell their clients exactly what they want to hear. They lack integrity, conviction, and independence. They are like one of the protagonists in the joke about the wildlife biologist who goes to a small town in the Rockies to study mountain lions. In the general store, he asks the clerk if he’s ever seen any mountain lions around the town. “Absolutely not,” the clerk replies, seeking to reassure the stranger.

“That’s too bad,” says the biologist. “I’ve come out here from Boston to study them, and was hoping to stay awhile.”

“Actually,” the clerk tells him, hoping he’ll stay, “I saw a big one just last night near my house.”

Think about the accountants and consultants and investment bankers who were advising Enron during their heyday. They told Jeff Skilling at Enron exactly what he wanted to hear, and they reaped huge amounts of business as a result.

5. Crowd-followers. One CEO said to me, “A good outside advisor is someone who is really thinking on the edge, who will challenge the status quo and be willing to go against the crowd.” Out of insecurity, lack of imagination, or just plain conservatism, however, some professionals always advise their clients to go with the crowd, and they stick to preconceived notions about the right solution.

A friend of mine, who was a top executive at a leading brokerage firm in the 1990s, recently told me a story about crowd-followers in the financial advice industry: “During the 1990s, the online discount brokers like Charles Schwab and eTrade grew rapidly as the Internet boom accelerated. The strategy consulting firms all made the rounds with the exact same presentation, exhorting every major broker—Merrill, Paine Webber, etc.—to invest hundreds of millions in building online trading platforms. It turned out to be wrong advice. In fact, as soon as Schwab’s customers had any amount of money, they wanted more personal service and advice and often turned to a traditional, in-person financial advisor. The real answer was to invest in strengthening client relationships and use online tools and a Web presence to augment them, not creating a whole separate online trading business.”

6. Recyclers. Clients want services tailored to their particular situation, not recycled, boilerplate advice. Polonius, who advises the king and queen in Shakespeare’s Hamlet, is a classic example of the advisor who offers stale, clichéd counsel. Spouting platitudes such as “Neither a borrower nor a lender be” and “Above all, to thine own self be true,” he exposes his own shallowness and lack of insight. Polonius recycles the same silly advice over and over.

A few years ago, a well-known consulting firm had been asked by a dozen different clients to study their affirmative action and diversity policies, and make recommendations. Two of the clients happened to compare the reports they were given, only to find them virtually identical—down to the specific recommendations, which were supposed to be tailored for each client. A reporter’s subsequent investigation surfaced the fact that all of the reports were essentially the same. The clients were furious.

7. Power Grabbers. Some advisors try to usurp their client’s power and prestige for themselves. Even though they are supposed to be behind-the-scenes counselors—in the wings, not stage-center—they use their relationship with their senior client to enhance their own fame. Henry Kissinger used to do this famously with former President Richard Nixon when he was Nixon’s national security advisor. He would frequently invoke the president’s name and say things like “The president is fully behind this” to bolster his own position. When the two of them landed in Beijing for their historic visit to China in 1972, one person on Air Force One reported that Kissinger tried to exit the plane alongside Nixon rather than behind him with other senior officials, and he had to practically be blocked from the doorway until the president had appeared on the stairs.

In your experience, what are some of the pitfalls that you have fallen into in working with clients? Have you had a brush with one of these seven? Leave a comment, below.